Making tough choices when there are no good options.

As inflation hit an all-time high since the Second World War in Europe, the ECB (European Central Bank) has hinted several times that it was going to raise interest rates and curb Quantitative Easing, that is, buying the debt of countries that do not have their budget balanced (countries that spend more money than they collect in taxes).

But the situation isn’t that simple.

Several countries in the EU have astronomically high levels of debt that needs to be serviced. In many cases, these countries borrow from the ECB to pay back interest rates on their debt and refund it.

Plainly, this means that these countries borrow to pay back their loans.

Management-wise, this isn’t very healthy.

The debt/GDP ratio in the Eurozone (zone of countries that use the euro or have their national currencies pegged to the euro) was at 95% at the end of 2021.

This means that when we add the debt of each country on top of each other, the total levels of debt are equal to 95% of the total value of what’s produced inside the EU in one year.

Per country, the levels of debt measured in percentage of GDP were as follows.

As we can see, seven countries have their debt going over 100% of their GDP: Greece, Italy, Portugal, Spain, France, Belgium, and Cyprus.

The problem is that these countries aren’t the small ones.

France, Italy, and Spain are the respective second, third, and fourth biggest economies of the Eurozone. Belgium is number eight.

These countries need Quantitative Easing to keep on paying salaries of civil servants, pensions, the military, etc.

Raising interest rates and curbing the debt purchase would mean that these countries would be cut off from a source of fresh money.

How Bad Is It?

When the Greek crisis hit in 2011–2012, it nearly broke the Eurozone apart.

At the time, countries couldn’t gather enough money to save the Greek economy despite it accounted for a mere 3% of the EU’s GDP.

When the Greek crisis first began at the end of 2010, the Greek debt/GDP was at 146%, which, at the time, was considered to be monstrously high.

But times have changed, apparently.

Today, Statista estimates that the Greek debt/GDP is at 185% which, weirdly enough, does not seem to trouble anyone.

As for Italy, its debt stands at 150% of its GDP, which is higher than Greece in 2010.

While Greece was comparatively small (and still is), consider that Italy makes up 12% of the GDP of all of the EU.

This means that the Italian debt problem is four times bigger than Greece's at the time.

France’s debt is at 112% of their GDP, and Spain’s, at 118%.

The ECB Is Stuck

In the 2010s, Barack Obama, then president of the US, had called on the EU to fix the Greek crisis because it destabilized the world economy.

Consider that today, France, Spain, and Italy account together for 38% of the EU’s GDP.

So, why is the ECB stuck?

Because these countries cannot function without QE.

The ECB is lending them a lot of money at very low-interest rates so that these countries can function properly.

If the ECB stops, these countries will have three options.

Drastically cut their spending, which socially, will be difficult and may end up being dangerous.

They will have to go bankrupt and take the entire Eurozone with them, which isn’t feasible.

They will have to revert back to their own currencies, which will create a mass exodus of people out of these countries.

This means that the ECB is in an awful situation.

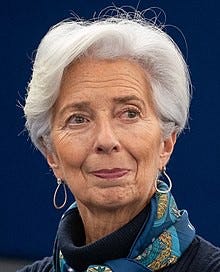

Christine Lagarde, ECB’s President, has two options.

The first option is to stop the purchase of debt and raise interest rates. Austerity will be established and there will be protests and a lot of anger on the ballots.

Austerity is, practically speaking, a decrease in state financial support, which will create a recession.

Why?

In the economy, someone’s spending is someone’s else income. If spending decreases, revenue decreases as well, hence economic activity decreases, hence salaries decrease. Hence, there is a recession.

Economic cycles last on average eight years. That means that countries can expect recessions every eight years.

The last one was in 2009. We haven’t had one since then.

That’s the first option.

The second option is that the ECB does nothing. They keep on lending to countries with low-interest rates.

As a result, countries keep on spending more than they produce, and inflation keeps on running until people can no longer afford rent, food, or energy (which is already happening).

Consumers spend less due to prices, a recession hits, and people take to the streets to protest.

Going Forward

The state of the European economy did not improve these last ten years — it worsened.

The debt/GDP ratio of the biggest economies in Europe has all but decreased.

And the lack of productivity, unchanged consumption patterns, and too much printing and lending have created inflation unseen in more than 70 years.

Whichever path the ECB decides to take, it will have to juggle limiting inflation on one hand, while not curbing money printing too much so as to not force countries to enter austerity, on the other.

A difficult exercise, to say the least.

What It Means For Investors

Several economists and investors have warned that the risk of a recession was extremely high.

As we saw, whatever the ECB does, and however countries decide to react next, a recession is almost inevitable.

When a recession hits, the stock market goes down, the value of gold goes down, and real estate goes down.

This is the case for almost all assets, except one.

Land.

Land’s value is not derived from economic conditions. Land appreciates when the value of its output (food) appreciates.

Food is consumed regardless of the state of the economy. In fact, the volume of food consumed does not depend as much on the economy as it does on the number of people that need to be fed.

As the world population increases, food, hence land, is one of the few assets that keeps on increasing — or at least, does not go down as much as the stock market which can lose 50% of its value in a few weeks.

With LandEx, you can start investing in land with as little as €10 and protect your money against the risk of a recession.

Register on landex.ai today, and begin your land investment journey.

The content of LandEx’s blog is for informational purposes only, you should not construe any such information or other material as investment, financial, or other advice. Nothing contained on the LandEx Medium blog constitutes a solicitation, recommendation, endorsement, or offer by LandEx or any third party service provider to buy or sell any financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.